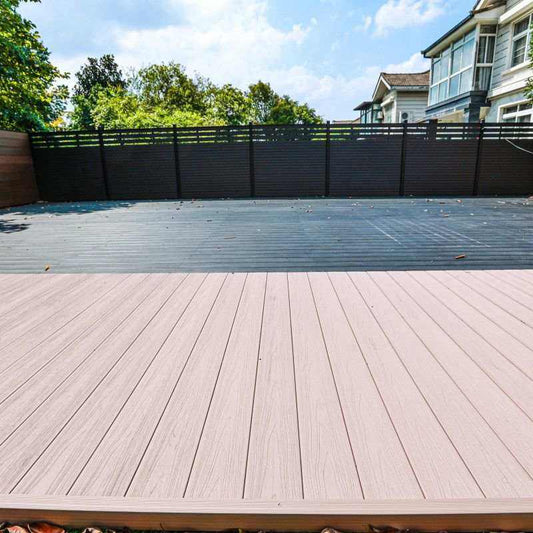

Introduction to Ultra Guard Tech Wood Deck and Trex

Ultra Guard Tech Wood Deck and Trex are two popular options for homeowners seeking durable, low-maintenance, and attractive alternatives to traditional decking materials. Each option leverages innovative technology that delivers enhanced performance, weather resistance, and aesthetic versatility. This section explores their key features and distinctions to help readers evaluate their suitability for various outdoor projects.

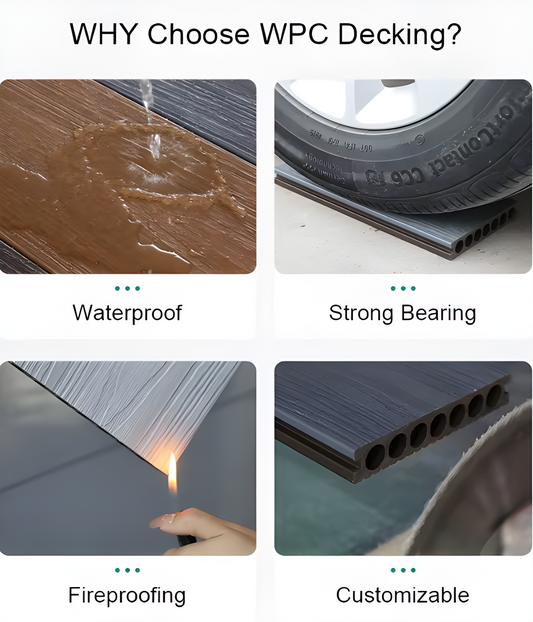

Ultra Guard Tech Wood Decking incorporates advanced protective coatings to enhance the lifespan of composite decking materials. Its manufacturing process involves blending recycled wood fibers and plastics, offering both environmental sustainability and structural resilience. The protective layer helps resist scratches, stains, fading, and moisture infiltration, making it an ideal choice for high-traffic areas or regions prone to extreme weather conditions. Additionally, Ultra Guard Tech decks often feature deep wood-grain textures and rich color palettes, emulating the appearance of natural wood while requiring minimal upkeep.

Trex decking, a leader in composite decking, follows a similar manufacturing philosophy, crafting its boards from up to 95% recycled materials. Trex is well-regarded for its exceptional weather resistance, maintaining its durability against rain, UV rays, and freeze-thaw cycles. Its proprietary shell technology provides added protection against mold growth, cracks, and peeling without ever needing sanding or staining. Trex is available in a variety of collections that cater to modern, traditional, and rustic design preferences. Furthermore, Trex’s eco-friendly production processes have earned it certification from multiple environmental organizations.

Both Ultra Guard Tech and Trex offer homeowners peace of mind through comprehensive warranties that typically cover stain resistance, discoloration, and structural integrity. Transitioning from natural wood to either of these products represents a commitment to reduced maintenance demands and heightened long-term value. The choice often comes down to personal style preferences, budget considerations, and the specific features that match a project’s requirements.

|

|

|

|

|

|

|

|

|

|

|

|

Understanding the Importance of Cost Comparison in Decking Materials

The choice of decking material significantly impacts the overall cost, functionality, and longevity of an outdoor project. Understanding the importance of cost comparison among available materials facilitates more informed purchasing decisions, ensuring every dollar spent enhances value. Whether selecting products from Lowe’s, Home Depot, or Ultra Guard Tech, evaluating cost implications is essential to achieve the right balance between price and performance.

Decking materials typically fall into categories such as treated lumber, composite, vinyl, or specialized hybrid materials. Each of these options varies in terms of upfront cost, installation expenses, and long-term maintenance requirements. For example, pressure-treated wood is often more affordable initially but may demand higher maintenance costs over time compared to composite decking, which is pricier upfront but requires minimal upkeep. Recognizing these cost trade-offs empowers consumers to align their choices with not only immediate budgets but also lifecycle considerations.

Additionally, fluctuation in prices based on supplier, quality, and features must be evaluated. Top retailers like Lowe’s and Home Depot typically offer a wide range of price points suitable for different budgets. Ultra Guard Tech, a specialized brand, may present premium innovations like enhanced durability or weather resistance, which could justify higher costs for consumers prioritizing longevity or unique features.

Shipping fees, warranties, and regional availability further influence overall expenditure. A thorough cost comparison entails understanding these nuances to avoid unforeseen expenses and ensure transparency in decision-making. By focusing on total cost of ownership—encompassing initial purchase, installation, and maintenance—buyers can optimize their investment while ensuring their decking solution meets durability and aesthetic expectations.

Initial Purchase Cost: Ultra Guard Tech Wood Deck vs Trex

When evaluating the initial purchase cost of Ultra Guard Tech Wood Deck and Trex, homebuyers and contractors will find noticeable differences in pricing structures, materials, and available product tiers. Both brands aim to cater to homeowners seeking durable, weather-resistant decking options, but affordability varies based on preferences, project sizes, and specific product lines.

Ultra Guard Tech Wood Deck

Ultra Guard Tech Wood Deck is positioned as a wood-polymer composite deck that balances aesthetics with functionality. Priced competitively, it offers multiple product grades ranging from economy options to premium selections. The base-level boards typically cost $2.50 to $4 per linear foot, depending on the retailer and specific designs. Premium options, which provide advanced scratch resistance and higher resilience to UV damage, range between $4.50 and $7 per linear foot.

- Additional Costs: Homeowners may expect additional expenditures for matching fascia, railing systems, or necessary accessories, which vary but generally stay within budget-friendly tiers.

- Cost Factors: Costs tend to rise due to offerings like embossed textures or enhanced environmental resistance.

Trex

Trex, a highly recognizable name in the composite decking market, comes at a higher general price point. Entry-level options, part of the Enhance Basics line, start at approximately $4.50 per linear foot, while premium Transcend boards extend upward to $9 or more per linear foot, offering superior durability and fade resistance. The brand emphasizes sustainability and low maintenance, but this often reflects in the upfront price.

- Additional Costs: Trex accessories, such as coordinating trim, end caps, and fasteners, typically add to the overall expense.

- Cost Factors: Customization, advanced protective shells, and luxury textures increase the cost of Trex products significantly.

Key Cost Considerations

Ultra Guard Tech appeals to budget-conscious buyers, providing a cost-effective solution without sacrificing essential durability. Trex, while costlier, attracts those prioritizing long-term value and advanced design features.

Long-Term Durability: Which Offers Better Value Over Time?

When evaluating deck options from Lowe’s, Home Depot, and Ultra Guard Tech, long-term durability becomes a critical factor for any homeowner or contractor making an investment. Each brand presents unique features and construction methods that influence how well their decks withstand years of exposure to the elements, wear, and usage.

Lowe's - Well-Known for Pressure-Treated Lumber

Lowe’s provides a broad range of decking materials, with pressure-treated wood being one of the most popular choices due to its affordability and resistance to rot and termites. Over time, however, such wood typically requires regular maintenance, including sealing and staining, to sustain its durability. If neglected, pressure-treated decks from Lowe’s are prone to warping, cracking, and splitting under prolonged exposure to moisture and ultraviolet rays, potentially leading to reduced value despite their lower initial cost.

Home Depot - Composite and Treated Options

Home Depot carries composite decking as well as traditional wood options. Their composite materials, such as Trex, are made from recycled plastics and wood fibers, offering impressive durability against pests, weather, and general wear over several decades. Compared to wood, composite decks require less maintenance, retaining their structural integrity and appearance over the long term. However, slight surface fading over time can be an issue, though it does not compromise overall performance. Treated wood from Home Depot faces the same challenges as Lowe’s lumber, including susceptibility to long-term moisture damage when not regularly maintained.

Ultra Guard Tech - Engineered Durability

Ultra Guard Tech specializes in premium composite decking that integrates advanced polymer technology. These decks are designed to resist fading, cracking, and staining, even in challenging climates. Ultra Guard Tech’s products often feature capped composite designs, where a protective layer shields the core, reducing risks of scratches and moisture penetration. Longevity is further enhanced by extended warranties offered by the manufacturer, providing additional assurance for those prioritizing long-term value. The main drawback is the higher upfront cost compared to other options, but the material’s durability can offset this over time.

Key Considerations

- Maintenance Requirements: Wooden decking demands consistent upkeep, while composite options from Home Depot or Ultra Guard Tech substantially reduce ongoing labor and costs.

- Environmental Factors: Durability is often impacted by exposure to extreme weather. Composite materials and advanced coatings perform better under such conditions.

- Upfront vs. Long-Term Costs: While pressure-treated wood incurs lower initial costs, it may become costlier over time when factoring in maintenance and repairs.

Understanding each brand's durability in tandem with maintenance needs helps in determining which deck truly delivers better value over the long haul.

Maintenance Costs: Keeping Your Deck in Top Shape

When evaluating the overall value of a deck, maintenance costs play a pivotal role. The longevity, durability, and maintenance requirements of a deck can significantly impact the total cost of ownership. Each deck type—whether sourced from Lowe's, Home Depot, or Ultra Guard Tech—comes with its own unique maintenance demands, making it essential to understand these aspects before deciding on an option.

Wood Decks are a popular choice at Lowe’s and Home Depot, but they demand regular upkeep. These decks typically require annual cleaning, staining, or sealing to prevent weathering, splitting, or warping. Cleaning products, stains, and sealants can add up in cost over time, with average annual maintenance expenses ranging between $300 and $600, depending on the size of the deck. Furthermore, untreated wood is prone to rot and pest infestations, leading to additional repairs.

Composite Decks, such as those featured by Ultra Guard Tech and other brands at Lowe's and Home Depot, offer a lower-maintenance alternative. These decks require periodic cleaning with mild soap and water but do not need staining or sealing. They resist fading, scratching, and rot more effectively than wood, reducing the possibility of frequent repairs. On average, composite deck maintenance costs are estimated to be $100 to $200 annually, a significantly lower investment compared to wood.

Vinyl and PVC Decks are often highlighted for their minimal upkeep demands. Available through certain product lines at Lowe’s and Ultra Guard Tech, these materials typically only need occasional rinsing with a hose or light scrubbing to remove dirt and debris, making them suitable for homeowners seeking ease of cleaning. Maintenance costs for these decks often fall below $100 per year.

The cost variance between these materials underscores the importance of evaluating which deck aligns with your desired maintenance level and budget. Balancing upfront costs with long-term upkeep expenses is key to making an informed decision.

Aesthetic Appeal: Price vs Visual Value

When evaluating the aesthetic appeal of deck materials offered by Lowes, Home Depot, and Ultra Guard Tech, it is essential to balance cost with visual quality. Each retailer provides options that cater to diverse design preferences, but the level of sophistication in appearance, texture, and adaptability for various outdoor themes varies.

Lowes offers an array of decking solutions that focus on classic finishes. Customers can select from traditional wood tones as well as trendy composite styles. While their products are competitively priced, particularly their treated lumber, some may argue that the aesthetic detailing lacks the refinement found in higher-end alternatives. Nonetheless, for those who prioritize affordability over intricate design, Lowes remains a viable choice.

Home Depot stands out with its extensive collection, including premium composite options from brands like Trex and TimberTech. These materials not only emulate the natural look of wood but also come in distinctive color palettes and grain patterns. However, these refined visuals come at a higher price point, making them better suited for projects where elegance outweighs budget constraints. Additionally, Home Depot stocks customizable railing and trim kits to enhance the deck's overall appearance.

Ultra Guard Tech, on the other hand, positions itself as a specialized provider of modern composite materials. Their decking options often boast sleek finishes, durability, and vibrant hues that resist fading. While these products deliver a contemporary aesthetic unmatched by many competitors, their premium pricing excludes them from being cost-effective for budget-conscious shoppers. Ultra Guard Tech’s focus on long-lasting visual appeal attracts homeowners prioritizing a stylish, polished look.

Ultimately, while Lowes appeals to cost-conscious buyers and Home Depot bridges the gap between luxury and value, Ultra Guard Tech invests heavily in visual sophistication, albeit at significantly higher costs.

Environmental Impact: Eco-Friendliness and Cost Considerations

When comparing decking options from Lowes, Home Depot, and Ultra Guard Tech, evaluating environmental impact and associated costs is essential for an informed decision. Each brand offers unique attributes that cater to eco-conscious customers while balancing affordability.

Materials and Eco-Friendliness

- Lowes: Decking options from Lowes primarily include materials like treated wood and composite boards. While treated wood is durable, its manufacturing process involves chemicals that may pose environmental risks. On the other hand, composite boards at Lowes typically incorporate a blend of recycled plastics and wood fibers, presenting a more sustainable choice.

- Home Depot: Home Depot stocks diverse decking options, including FSC-certified wood and composite alternatives. FSC-certified wood ensures responsible forestry practices, making it appealing to eco-conscious consumers. Moreover, their composite decking options showcase technology that incorporates recycled materials, reducing landfill waste.

- Ultra Guard Tech: Ultra Guard Tech focuses heavily on environmental sustainability, exclusively utilizing 95% recycled materials, including reclaimed wood and recycled plastics, in their premium composite offerings. The manufacturing processes are often designed to minimize carbon emissions, setting the company apart in eco-conscious innovations.

Durability vs. Environmental Cost

- Treated wood, while cost-effective, may need frequent treatments, leading to increased solvent and sealant usage over its life cycle. Composite materials from each provider tend to require less maintenance, translating into fewer replacements and reduced resource consumption over time.

Cost Implications of Sustainability

The upfront pricing for environmentally friendly materials like composite boards from Ultra Guard Tech is higher compared to treated wood at Lowes or Home Depot. However, reduced maintenance costs and longer lifespans may offer savings in the long term. Customers should weigh initial investments against potential future costs to identify the best value for their budget and environmental priorities.

By understanding the environmental impact and cost dynamics, consumers can weigh eco-friendliness against personal financial goals when selecting a decking solution.

Installation Costs: Professional vs DIY for Both Options

When deciding between Lowe’s, Home Depot, or Ultra Guard Tech for decking solutions, installation costs vary significantly depending on whether a professional service is hired or the project is undertaken as a DIY effort. Each option has distinct advantages and financial considerations tied to the choice of installation method.

Professional Installation Costs

- Lowe’s: Professional installation services offered by Lowe’s typically include labor, materials, site preparation, and debris cleanup. Labor costs per square foot are often mid-range compared to competitors. However, additional charges for accessories, customizations, or unexpected complications—such as uneven terrain—can increase overall expenses.

- Home Depot: Home Depot’s professional installation services generally align with industry averages. The company places a strong emphasis on bundled pricing, which might include deck materials, consulting fees, and warranties. While often competitive for basic installations, premium upgrades or personalized designs can sharply increase the final cost.

- Ultra Guard Tech: Ultra Guard Tech’s professional installation often comes with a specialized focus on the durability and customization of their composite and PVC decking materials. Although the upfront costs may be higher, lower maintenance needs can offset long-term expenses. Professional installation from Ultra Guard Tech is favored for projects requiring advanced customization or modern finishes.

DIY Installation Costs

- Lowe’s: For DIY enthusiasts, Lowe’s provides transparent guidance with instructional resources, material calculators, and tool rental options. Those opting to self-install can expect savings on labor but may need to account for the purchase or rental of advanced power tools.

- Home Depot: Home Depot caters heavily to DIY customers with extensive material choices and hands-on workshops. Their tool rental services are competitive, but unexpected costs, such as additional hardware or minor subcontracting, can arise for inexperienced DIYers.

- Ultra Guard Tech: Ultra Guard Tech supports DIY customers through detailed manuals and virtual customer support. However, the advanced materials they often supply may require more specialized tools and higher expertise levels compared to wood-based options.

Hidden Costs: Warranties, Repairs, and Add-Ons

When evaluating decking options from Lowe’s, Home Depot, and Ultra Guard Tech, understanding the hidden costs associated with warranties, repairs, and add-ons is critical to determining overall value. Retailers often advertise the initial price of deck materials prominently, yet these additional expenses can significantly affect long-term affordability.

Warranties: What’s Included and What’s Not

The deck warranties provided by leading brands underscore notable differences. Lowe’s and Home Depot typically offer manufacturer warranties ranging from 10 to 25 years, depending on the decking material. These warranties often cover defects in manufacturing but exclude damages from improper installation or wear-and-tear due to weather. Ultra Guard Tech, however, provides a comprehensive 30-year warranty that includes structural repairs and resistance to fading or staining. Nevertheless, their coverage requires adherence to strict installation guidelines, which may necessitate professional installation.

Repairs: Material and Labor Costs

Repair costs vary significantly based on the type of decking and the retailer’s materials. Lowe’s and Home Depot cater to DIY-friendly customers, offering affordable replacement boards. However, for specialized materials like composite decking, professional repairs can escalate costs due to labor fees. Ultra Guard Tech markets itself as low-maintenance, meaning fewer repair concerns due to its reinforced composite technology. Despite this, replacement boards from Ultra Guard can be cost-prohibitive compared to more standardized offerings from large retailers.

Add-Ons: Necessary or Optional?

Add-ons, such as railings, fasteners, and protective treatments, can inflate the final cost of a deck. Lowe’s and Home Depot often offer bundled deals that lower the price of these accessories when purchased with materials. Ultra Guard Tech emphasizes premium add-ons, such as custom railings and UV-resistant coatings, which increase durability but come at a noticeable premium. Consumers must weigh these enhancements against their budget and project needs.

Understanding these hidden costs ensures informed decision-making when selecting a decking solution for long-term durability and value.

Resale Value: How Each Decking Option Impacts Home Worth

When considering the impact on a property's resale value, the choice of decking plays a critical role. Potential buyers often view outdoor living spaces as desirable amenities, and the material, appearance, and durability of a deck can directly influence home value. Examining the resale contributions of popular decking options ensures homeowners are making a financially sound decision.

Pressure-Treated Wood (Lowes and Home Depot Options)

Pressure-treated wood remains a top choice for those seeking affordability, yet its long-term influence on resale value is mixed. While its initial cost is low, its tendency to require frequent staining, sealing, and eventual replacement may detract from long-term value. Homes with well-maintained wooden decks benefit moderately in resale, especially among traditional buyers, but neglect diminishes its appeal.

Composite Decking (Ultra Guard Tech and Similar)

Composite decking offers a modern, low-maintenance option that strongly appeals to homebuyers prioritizing durability. Ultra Guard Tech, in particular, touts resistance to weathering, fading, and warping, enhancing curb appeal over time. The higher upfront cost is often offset by its ability to maintain a like-new appearance for years, directly contributing to a premium resale. Composite decks are often seen as a high-value investment due to their longevity and low upkeep.

Cedar and Redwood Decking

Natural wood decks made from cedar or redwood, available at both major retailers, deliver an aesthetic boost. These materials attract buyers who appreciate organic beauty, but their resale value depends heavily on consistent maintenance. Cracking, fading, and susceptibility to insects can lower perceived worth, but well-preserved platforms elevate home desirability in niche markets.

A well-chosen, well-maintained deck enhances outdoor spaces, directly impacting potential resale value. Homeowners balancing budget with future payoff may find composite materials offer the most sustainable return.

Regional Pricing Variations: Influences on Overall Costs

One of the most critical factors influencing the overall cost of decking materials from Lowe’s, Home Depot, or Ultra Guard Tech is regional pricing variability. Geographical location not only affects material availability but also transportation fees, supply chain logistics, and even seasonal demand fluctuations, making deck pricing unpredictable across different regions. Retailers, including Lowe’s and Home Depot, often rely on local distributors, which can create disparities in costs for identical products depending on where customers are located.

Local regulations and building codes also contribute to pricing variations. Regions with stricter requirements for weather-resistant or eco-friendly materials might necessitate more expensive decking options or treatments. Ultra Guard Tech’s offerings, for example, might show stark price differences due to regional compliance with these codes, especially in coastal or high-humidity areas where extra durability is essential.

Tax structures and import fees can further widen cost discrepancies among regions. States with higher sales tax or those requiring specific certifications for decking products may incur additional charges, making the same deck material appear significantly more expensive in certain locations. Retailers like Lowe’s and Home Depot might offer discounts in states with lower tax rates to compensate for leaner customer demand, resulting in more competitive pricing.

Seasonality also plays a key role in costs. In colder regions, demand for decking materials often drops during winter months, prompting retailers to introduce localized promotions or clearance sales. Conversely, regions with year-round outdoor-friendly climates might see steadier pricing due to consistent demand. Transportation and logistical fees are equally important considerations, as supply routes and distances from manufacturing plants can directly impact retail pricing.

In sum, regional pricing variations stem from an interplay of logistical, legal, climatic, and market factors, all of which should be carefully assessed before committing to decking purchases from any retailer.

Comparing the Lifespan of Ultra Guard Tech Wood Deck and Trex

When evaluating decking materials, the longevity of the product is a critical factor for homeowners and contractors alike. Both Ultra Guard Tech Wood Deck and Trex stand out as durable options, but their performance under varying conditions showcases key differences in lifespan.

Ultra Guard Tech Wood Deck combines advanced engineering with a robust protective coating that resists moisture, UV damage, and mold growth. This high-performance layer ensures that the material maintains its structural integrity for an extended period. On average, Ultra Guard Tech Wood Deck boasts a lifespan of 25 to 30 years, even in climates with heavy rainfall or extreme heat. Additionally, its resistance to wear from foot traffic and abrasions adds to its long-term viability, making it suitable for busy, high-use exterior spaces.

Trex decking, a leading alternative, is known for its composite construction that blends wood fibers and recycled plastics. This design provides significant durability benefits against warping, splintering, and termite damage. Trex products typically last 20 to 25 years with minimal upkeep. However, they may show signs of color fading or surface wear over time, particularly in areas exposed to direct sunlight for prolonged periods. While it offers exceptional resistance to rot and decay, regular cleaning is recommended to prevent buildup of debris that could compromise its appearance.

The primary distinction lies in the material composition and the warranty terms offered. Ultra Guard Tech decks are often backed by stronger fade and stain resistance warranties compared to Trex, which does provide robust support but may require additional surface refinishing down the line.

By closely analyzing both materials, users can identify which product aligns best with specific environmental factors and maintenance capacities. The differences in predicted longevity emphasize the importance of thoroughly assessing individual needs before making an investment.

Budget and Lifestyle Considerations When Choosing a Deck

Selecting the right decking material involves evaluating both budgetary constraints and lifestyle requirements, as these factors deliver long-term value. Each option—whether from Lowe’s, Home Depot, or Ultra Guard Tech—caters to varying financial scenarios and individual preferences, making it essential to weigh costs against specific needs.

Financial Planning for Deck Investment

Decking solutions vary widely in price, with initial costs influenced by material type, brand reputation, and installation requirements. Pressure-treated wood, often available at retailers like Lowe’s and Home Depot, emerges as a budget-friendly choice. However, maintenance expenses, including sealing and staining, tend to accumulate over time, impacting long-term affordability. Ultra Guard Tech, which specializes in composite decking, may have a higher upfront cost but offers savings over time due to minimal upkeep.

For homeowners with limited budgets, opting for materials like lumber or basic composite boards is common. However, for those who can allocate higher financial resources, premium composite or PVC decking provides durability, aesthetics, and added resale value.

Lifestyle-Driven Decking Choices

Beyond finances, lifestyle considerations heavily influence decking decisions. Households with active outdoor lifestyles, pets, or regular gatherings might prioritize durability and scratch-resistant surfaces, common in Ultra Guard Tech’s products. Similarly, low-maintenance options appeal to families with busy schedules. Composite decks, available through Lowe’s and Home Depot, often require less effort compared to wood, making them ideal for such households.

Climate also shapes decisions. In regions with high humidity or temperature fluctuations, materials designed for weather resistance are paramount. Slip-resistant surfaces, such as those offered by certain Ultra Guard Tech products, enhance safety for families with children or elderly members.

Finding the Balance

Balancing cost with functional needs ensures an investment aligns with both personal and financial goals. Comparing offerings from Lowe’s, Home Depot, and Ultra Guard Tech while factoring in up-front costs, ongoing maintenance, and lifestyle fit is vital to achieving lasting value.

User Reviews and Feedback on Cost Effectiveness

When evaluating cost effectiveness, user reviews offer valuable insights into the long-term affordability and performance of decking products from Lowe's, Home Depot, and Ultra Guard Tech. Online forum discussions, retailer websites, and independent review platforms shed light on customer experiences with regard to pricing, durability, and maintenance costs.

Lowe's

- Customers frequently highlight the affordability of Lowe’s in-house brands compared to premium options.

- Many reviewers appreciate the frequent promotions and discounts available.

- However, some feedback reveals concerns about durability, with certain users noting that lower-cost options may require earlier replacement or more frequent upkeep.

- Users who have installed Lowe's decks often cite budget-friendly solutions for smaller or temporary projects.

Home Depot

- Home Depot receives praise for offering a wide spectrum of decking options across varied price points.

- Customers note that mid-range and premium collections deliver better long-term value due to their quality and reduced maintenance requirements.

- While the initial costs may be slightly higher than some competitors, user feedback suggests these products often perform better over time, reducing replacement and repair expenses.

- A few critical reviews point out occasional inconsistencies in lumber quality for economy-tier selections.

Ultra Guard Tech

- Reviews often emphasize the premium pricing of Ultra Guard Tech decking, describing it as a long-term investment rather than a quick budget option.

- Users commend the products for their superior durability and low maintenance demands, which help offset heftier upfront costs.

- Multiple testimonials refer to enhanced cost efficiency over time due to fewer repairs or replacements compared to other brands.

- However, others note that Ultra Guard Tech may not be ideal for consumers seeking short-term or upfront savings.

Feedback across all platforms consistently underscores the need to balance initial expenses with durability and maintenance, as these factors heavily influence overall cost effectiveness.

The Final Verdict: Which Decking Material Offers the Best Overall Investment?

When assessing the overall investment of decking materials, several factors come into play, including cost efficiency, durability, maintenance requirements, aesthetic appeal, and long-term value retention. Each brand—Lowe’s, Home Depot, and Ultra Guard Tech—positions its decking solutions toward a particular market, making the comparison multifaceted.

Cost Efficiency

Lowe’s offers decking materials at a wide range of prices, catering to budget-conscious buyers while maintaining competitive quality. Home Depot follows a similar approach, with slightly better options for bulk pricing and cost-effective composite solutions. Ultra Guard Tech, however, positions itself as a premium option. While its upfront cost is higher, the ongoing savings associated with its low-maintenance requirements may appeal to specific buyers.

Durability and Lifespan

Ultra Guard Tech leads in terms of durability. Its high-performance capped composite decking demonstrates superior resistance to stains, fading, mold, and scratches, making it an excellent option for regions with extreme weather. Lowe’s and Home Depot decks are durable as well, but reviews suggest a shorter lifespan when subjected to comparable environmental conditions.

Maintenance Considerations

Maintenance is pivotal in understanding long-term costs. Lowe’s and Home Depot offer pressure-treated wood options that require frequent staining and resealing to maintain their appearance. Conversely, Ultra Guard Tech’s composite materials are virtually maintenance-free, needing only occasional cleaning to stay pristine. This distinction often makes a significant impact over the years.

Aesthetic and Customization Options

Visual appeal is where Ultra Guard Tech outshines the competition, providing a modern, high-end look with diverse designs and colors. Home Depot’s selection leans toward traditional styles, while Lowe’s balances modern and classic options, offering reasonable customization for mid-range buyers.

Longevity of Investment

While Lowe’s and Home Depot provide solid options for short-to-mid-term projects, Ultra Guard Tech emerges as the leader for those prioritizing long-term value. Its resilience against wear and tear ensures that, despite its initial cost, it holds up as a worthwhile investment over time.

Conclusion: Making the Right Choice for Your Decking Needs

When deciding between Lowe’s, Home Depot, and Ultra Guard Tech for decking materials, several critical factors must be weighed to ensure the best value for your investment. The choice depends on individual preferences, budget, intended use, and expectations regarding durability, aesthetics, and long-term maintenance.

1. Product Range and Availability Lowe’s and Home Depot carry extensive product lines, offering a mix of traditional wood and composite decking options. Both retailers provide versatility in terms of design choices, accommodating a range of price points. Home Depot, in particular, emphasizes affordability for budget-conscious homeowners, while Lowe’s tends to offer slightly more premium finishes alongside competitive mid-tier options. Ultra Guard Tech, though specialized, focuses exclusively on high-quality composite decking, providing superior longevity and innovative features for those prioritizing modern, sustainable materials.

2. Quality and Performance The longevity of a deck depends heavily on its construction material. Home Depot’s pressure-treated wood is a popular low-cost option but requires ongoing maintenance to prevent wear and weathering. Lowe’s composite offerings deliver better resistance to elements, while Ultra Guard Tech’s proprietary technology often outlasts traditional materials, making it a preferred choice for low-maintenance and eco-friendly decking solutions.

3. Service and Installation Support Home Depot and Lowe’s excel in customer support, including online guidance, in-store consultation, and access to professional installers. Ultra Guard Tech, despite its narrower distribution network, provides tailored support and professional expertise, often bundled with direct-to-consumer services that ensure seamless installation.

Ultimately, the most appropriate choice lies in aligning personal requirements with the distinct strengths each provider offers. Factors such as long-term value, usability, and product warranties should be carefully examined to ensure an informed purchase decision.